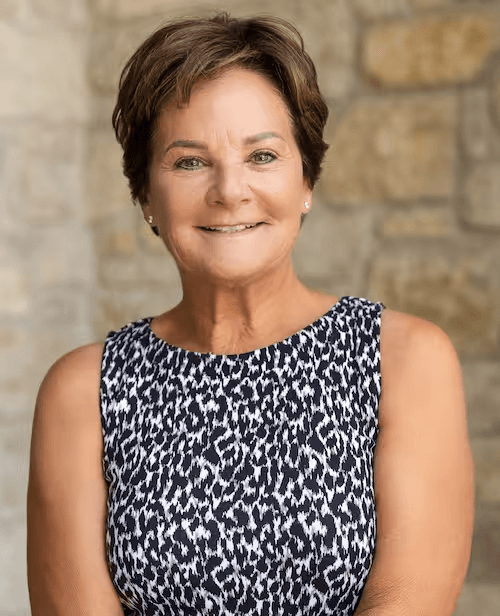

SSL Associates is led by Susan Lewis, a CPA with a proven track record. After graduating from the University of Illinois and gaining experience with a Big Six firm, Susan founded SSL Associates in 1986.

Susan’s passion lies in personalized service and building strong client relationships. She leverages her extensive experience (including Series 6, 7, 63, and 65 licenses) to deliver comprehensive financial guidance beyond traditional audit and assurance.

Susan understands the challenges faced by businesses. She built SSL Associates with a family-oriented culture, fostering a team environment focused on open communication and personalized service. This translates into deep client understanding and tailored solutions for success.

Susan’s commitment extends to the community through her involvement on various boards. With Susan at the helm, SSL Associates remains a trusted advisor, guiding businesses towards financial excellence.