Understanding how much your HOA should keep in its operating account is key to financial health, service continuity, and resident trust. Whether you’re a new or experienced board member, this guide will help you determine the right amount—and why it matters.

The Two Types of HOA Accounts

Typically, an HOA has at least two accounts. This method allows for the division of funds for different purposes, supports easier bookkeeping, and provides the financial transparency residents crave. Larger HOAs may have more than one account of each type.

1/2 Operating Funds

Operating funds are for monthly, routine operational expenses. Typically, all of the expenses for this account are for line items like community maintenance or amenities, which have a fixed price. However, it can include periodic maintenance as well, such as spring landscaping cleanup, depending on how your community is structured. Often, this is a checking account.

The amount in your operating fund is often determined by the board itself. The board sets targets, analyzes current spending, and keeps running expense lists to arrive at a figure. As a member of your board, you should bring up operating fund discussions regularly and include them in any budget proposals.

2/2 Reserve Funds

Reserve funds are for one-time or large projects. For example, a reserve line item might be a new roof for your community amenity building that needs replacing in the next five to ten years. This account is often a savings account.

Reserve funds can be tricky to calculate, so your HOA may employ an outside agency like SSL Associates to perform a reserve study. At any given point, having funds for at least 50% of the repairs forecasted in a reserve study for the next 20 to 30 years is a good position to be in.

What the Funds in an HOA Operating Account Should Cover

The operating account goals and thresholds are less concrete than your HOA’s reserve account targets. The operating account should be able to cover the monthly expenses, but what your HOA includes as a monthly expense can be highly variable. This is especially true if you do annual service billing.

1. Routine Community Items

Part of the appeal of an HOA community for most residents is that the routine maintenance is handled for them. When you’re looking at your HOA’s budget, you should also have a list of community amenities. That way, you can compare to ensure all the routine expenses are accounted for in the operating budget.

As you can see, the operating account covers many different areas. Some of these expenses may be billed for the quarter, year, or other specified period. Your understanding and specific planning can help ensure the operating account maintains a healthy balance for your HOA situation.

2. Administrative Expenses

In addition to routine expenses, an operating account must also account for smaller monthly expenses. Many of these are directly related to your HOA board, and they may be billed on different cycles.

Example expenses include:

- Office expenses.

- Taxes.

- HOA management.

- Legal fees.

- Report preparation.

- Budget or reserve studies.

- Software.

The administrative expenses can vary widely between HOAs, so it’s essential to understand precisely how yours is structured and the legal requirements in your area. Serving on the board of a smaller community may mean you’re directly responsible for some things a larger HOA outsources.

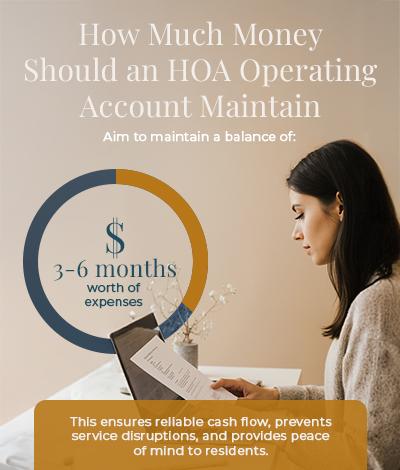

How Much Money Should Your HOA Have in an Operating Account?

As a general rule of thumb, an HOA operating account should have between three and six months’ worth of expenses in it. Some HOAs keep less in their operating account and rely on timely dues collection. Others hold more in the operating account to absorb unexpected costs, like historic storm damages.

1. What are Your HOA’s Monthly Expenses?

To arrive at a figure, you must first understand your HOA’s routine expenditures, many of which deliver the community amenities your HOA residents love. Once you know these expenditures and can compare them to the monthly dues revenue, you can start to see whether the operating account budget is operating at an appropriate level.

In general, it’s best to maintain a few months’ worth of expenses. Once you have a figure, you can multiply it so that your HOA has an appropriate cushion. By doing so and keeping a close eye on the monthly expenditures, you can account for any changes without imposing a special assessment.

2. How Reliable is Dues Collection?

Dues collection should be straightforward and regular. However, your HOA will have residents who are late, waiting for a paycheck, on a fixed income, or any number of other circumstances that disrupt dues collection. If you can forecast, it can inform your operating budget.

As 2020 taught everyone, one event can reshape the world. HOA dues are sometimes the first thing people delay when their budgets are disrupted. Your HOA board needs to account for this when setting the benchmarks for your operating account.

Note: This blog is for informational purposes only and should not be considered advice.