What Is a Chart of Accounts?

A chart of accounts is a simple list. It shows every category your HOA uses to track money. It shows money coming in and money going out. It also tracks what you own and what you owe.

Think of it as a quick guide to your money. It shows you where to look when you need info. With a clear setup, anyone can open the books and follow the flow. You see money coming in. You see money going out. You see what stays in the bank.

Without it, things get messy fast. One payment ends up under repairs, another under landscaping, and the next under “misc.” You waste time guessing. Board meetings run long. Budgets fall apart.

The chart brings order. It lets your treasurer work faster. It makes audits cleaner. And it gives your board the one thing every HOA needs: clarity.

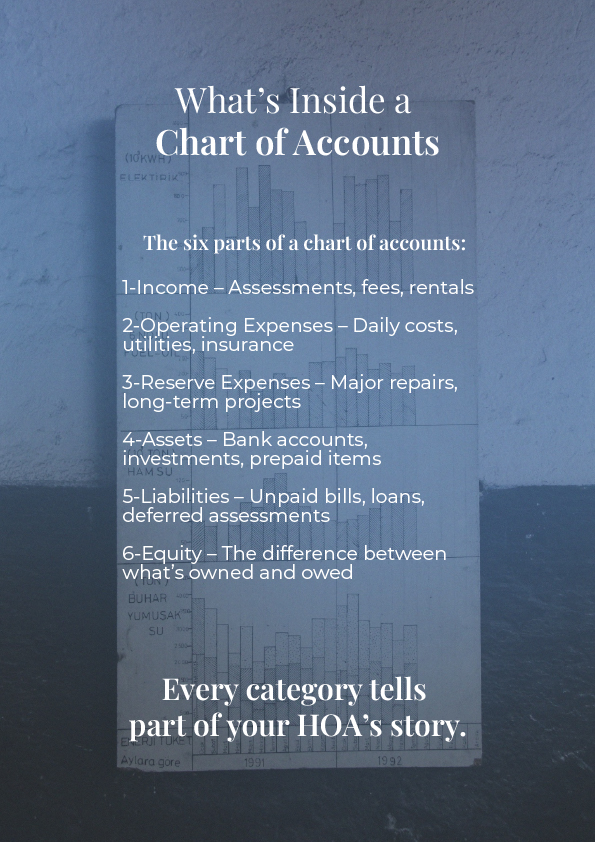

What’s Inside a Chart of Accounts

A chart of accounts splits your HOA’s money into clear buckets. Each bucket shows a different part of the picture.

a. Income

This covers all the money that comes in. Most of it comes from assessments. You may see late fees or fines here. Rental income can show up too. Someone may even pay to use the clubhouse for a party.

b. Operating Expenses

This is the day-to-day spending. You’ll see regular costs like landscaping and water. Trash pickup and power sit here too. Insurance and cleaning fall in this group as well. Anything that keeps things running lands here.

c. Reserve Expenses

This section covers major repairs or future projects. Think roof replacements, repaving, or a new security gate. These are not regular bills. They are big jobs you plan and save for ahead of time.

d. Assets

Assets are what the HOA owns. This includes your checking and savings accounts, long-term reserves, and anything prepaid like insurance or service contracts.

e. Liabilities

Liabilities are what you owe. This includes unpaid bills, outstanding loans, and deferred assessments. If the HOA has promised to pay something but hasn’t yet, it lands here.

f. Equity

Equity shows your net position. It’s the difference between what the HOA owns and what it owes. This section shows if you’re in the black or in financial trouble.

How a Good Chart Prevents Problems

Here’s an analogy. You’ve got two toolboxes. One has every tool in the right place. The other is a jumble of loose screws and mystery parts. One saves time. The other causes headaches.

That’s what it’s like running an HOA without a clear chart of accounts. Reports take too long to read. Budgeting turns into guesswork. Mistakes go unnoticed. The board starts doubting the numbers, and each other.

A clean chart keeps everything where it belongs.