Running an HOA takes more than planning. It requires strong systems and sound money management. What starts with a few late payments can quickly become a financial mess.

We’ve helped HOAs clean up everything from missing checks to six months of backlogged records. The difference a solid tracking process can make is massive. With the right system, dues stay on track and the workload lightens for the board and the community.

Why Dues Tracking Gets Messy

It’s easy to fall behind when no one really owns the process. Perhaps you’re still using an outdated spreadsheet from the last treasurer and a stack of paper checks. At first, it worked. But then someone moves out. Someone else forgets to pay. You get distracted by other board issues, and before long, the finances are anyone’s guess.

We worked with one HOA where nearly a quarter of the homeowners were behind on payments. No one had updated the ledger in months. Some had paid but weren’t marked as current. Others hadn’t paid in half a year and had stopped responding to emails.

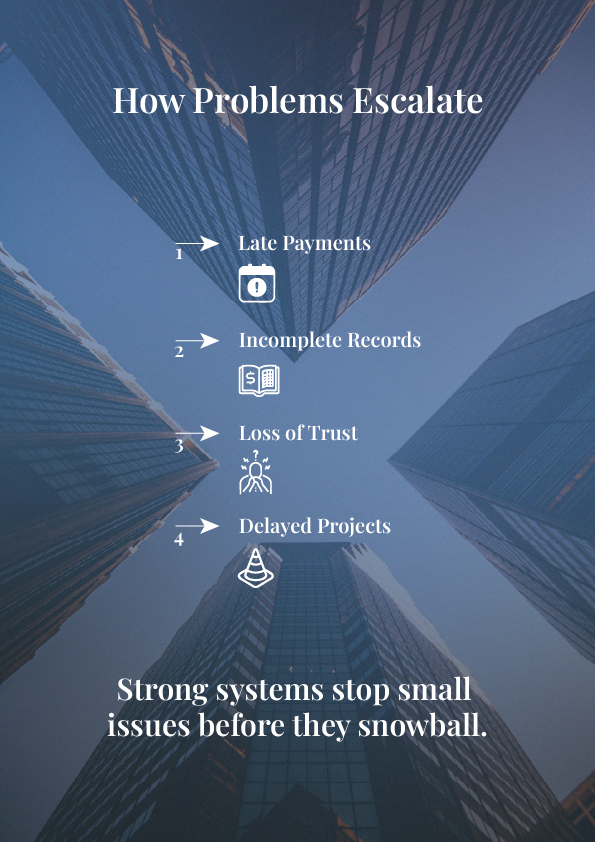

When dues tracking breaks down, it’s not just a bookkeeping issue. It damages trust. People stop believing the board knows what it’s doing. Projects get delayed. Reserves shrink. Arguments follow.

So let’s walk through what works.

Step One: Write a Proper Dues Policy

Most of the problems we see could be avoided with a well-written policy. Not a paragraph buried in your bylaws. A short, plain-language document that answers three basic questions:

- When are dues due?

- What happens if someone pays late?

- What do the dues cover?

Put this in your welcome packet. Add it to your community website. Mention it in every reminder. It shouldn’t be something people forget about.

We helped a mid-size HOA in Texas rewrite its dues policy after years of disputes. The new version set a firm due date, added a 10-day grace period, and clearly listed the steps for handling late payments. Within one billing cycle, late payments dropped by more than 50%.

Step Two: Use Software That Doesn’t Let You Down

Forget Excel. You need a system built for recurring payments and real-time tracking.

You don’t need to spend a fortune. Tools like AppFolio and Buildium are designed for HOAs and communities. Even QuickBooks can work, as long as it’s set up properly.

In one case, we helped an HOA with 43 homes switch from manual records to software with automated alerts. Their treasurer went from chasing checks every week to reviewing a dashboard once a month. They haven’t missed a payment since.

Good software should:

- Show who’s paid and who hasn’t

- Send automatic reminders

- Accept online payments

- Export clean reports for meetings

Step Three: Send Reminders That Actually Get Read

Most people aren’t refusing to pay. They just forget.

We recommend sending notice a week before the due date as a friendly reminder, and then again on the day it’s due.

Text messages can work well for those who need a little extra nudge. So do printed notices slipped into mailboxes. One HOA we worked with got great results by posting payment reminders on their community Facebook page. Whatever gets attention, use it.

Step Four: Reconcile Monthly, Not Just at Tax Time

Even with automation, you still need eyes on the books. Each month, match every payment to your records. Confirm that deposits cleared. Flag any short payments or bounced checks.

Split the responsibility. If one person enters the payments, have someone else double-check the records. This protects against fraud and honest mistakes.

We’ve handled accounts where a board member accidentally logged the same check twice. No harm was done, but without monthly reviews, it could have caused real confusion at audit time.

SSL runs monthly reconciliation checks for our HOA clients. We look for gaps, overlaps, or warning signs before they snowball.

Step Five: Handle Late Payments with a System, Not Emotion

Don’t let it get personal. That’s the fastest way to lose trust.

Instead, have a process and stick to it. When a payment is late:

- Send a formal notice with the amount due and any late fees

- Reference the policy they agreed to

- Offer a short-term payment plan if appropriate

- Follow up on schedule

If someone still doesn’t pay, move to the next step. That might mean legal action, or even a lien if your governing documents allow it. But treat everyone the same. Consistency is what keeps things fair.

Step Six: Track Your Collection Rate

Most HOAs never check this. They assume things are fine unless someone complains. But it’s one of the best indicators of whether your tracking system works.

Here’s how to calculate it:

Total amount collected ÷ total amount billed = collection rate

Multiply by 100 to get your percentage. Anything below 95% means something’s off.

If your rate is low, review your process. Are reminders going out on time? Are dues amounts clearly communicated? Is the software easy to use? Fixing just one weak link often makes a big difference.

Case Study: One Messy Ledger, Cleaned Up Fast

A few months ago, we helped an HOA in the Midwest clean up a major payment backlog. The community had 43 homes, and 10 of them were behind, some by more than six months.

The treasurer was still using Excel. Checks were getting lost. No one could say for sure who had paid and who hadn’t.

In six weeks, eight of the ten delinquent homes were caught up. Three months later, they hadn’t missed a payment. It’s not about magic. It’s just about having the right tools and sticking to the plan.

Here’s what we did:

- Moved the HOA to proper accounting software

- Set up automatic reminders tied to due dates

- Reconciled six months of messy records