If you manage a homeowners association, you’ve probably heard people throw around the words audit and review like they’re the same thing, but they’re not. Knowing the difference matters, especially when budgets get tight or when the board wants answers.

We will take a look at what each one really means and how they work.

Two Jobs, Two Purposes

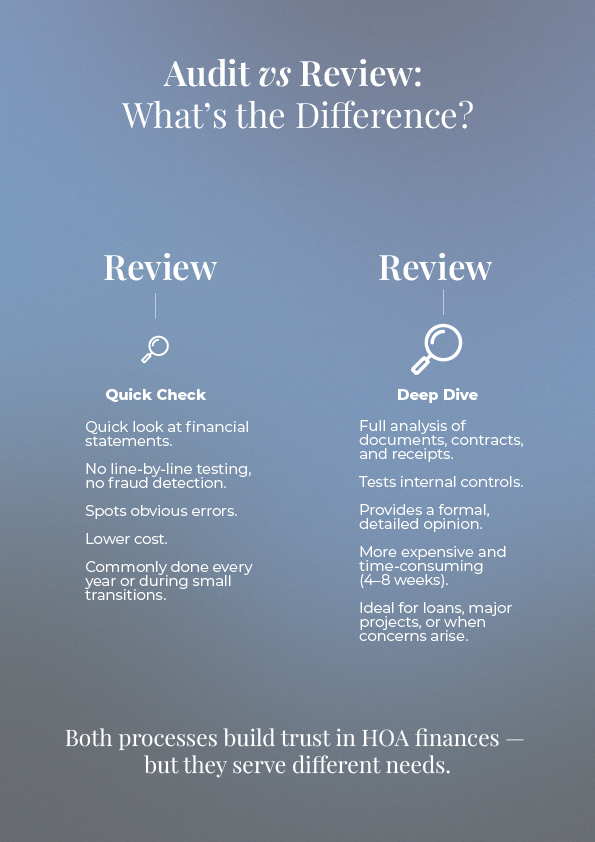

An audit and a review are both types of financial checkups. But one is more intense. Think of a review as a good once-over, while an audit digs deeper.

In a review, a CPA examines your financial statements to ensure they are accurate and consistent. They compare them to what they’d expect from a healthy HOA. If things look reasonable, they give a short report saying so. They don’t go line by line. They don’t test transactions or hunt for fraud. It’s a quick, affordable way to boost confidence in the books, especially if the board is handing things over to new members or answering owner questions.

An audit, on the other hand, is the full workup. The CPA does real detective work. They check bank records, contracts, and receipts. They test your internal controls. They ask tough questions. Then they issue a formal opinion: either everything adds up, or it doesn’t. If something’s off, they’ll flag it.

Audits are the gold standard, but they take time and money. Reviews won’t catch everything, but they’ll spot obvious issues and for a fraction of the cost.

Why HOAs Choose One Over the Other

There’s no single rule for when to do an audit or a review. Some state laws or HOA bylaws require boards to do one or the other. Others leave it to the board’s judgment.

In general:

- Reviews are common every year.

- Audits are often done every few years or when something big changes.

Let’s say your HOA just switched management companies. A review helps confirm the transition didn’t leave holes in the records. Or maybe you’re planning a major capital project. An audit could give everyone peace of mind before signing off on those reserves.

That’s exactly what happened with one community.When they finally pulled the trigger, the audit showed missing reserve transfers and flagged a vendor’s pattern of late payments.

On the flip side, we’ve seen reviews save HOAs from spending money they didn’t need to. One community worried about missing funds. A review showed it was just a reporting delay. Problem solved; no audit required.